UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |

| Filed by a Party other than the Registrant |

Check the appropriate box:

| Preliminary Proxy Statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Material under §240.14a-12 |

Ballantyne Strong, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | ||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

☐ | Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

PROXY STATEMENT AND NOTICE

FOR THE 20162021 ANNUAL MEETING OF STOCKHOLDERS

to be held at

The Westin4201 Congress Street, Suite 175

400 Corporate Drive

Fort Lauderdale, FL 33334Charlotte, North Carolina 28209

on

May 23, 2016December 6, 2021 at 1:5:00 p.m. (Local Time)(local time)

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held May 23, 2016December 6, 2021

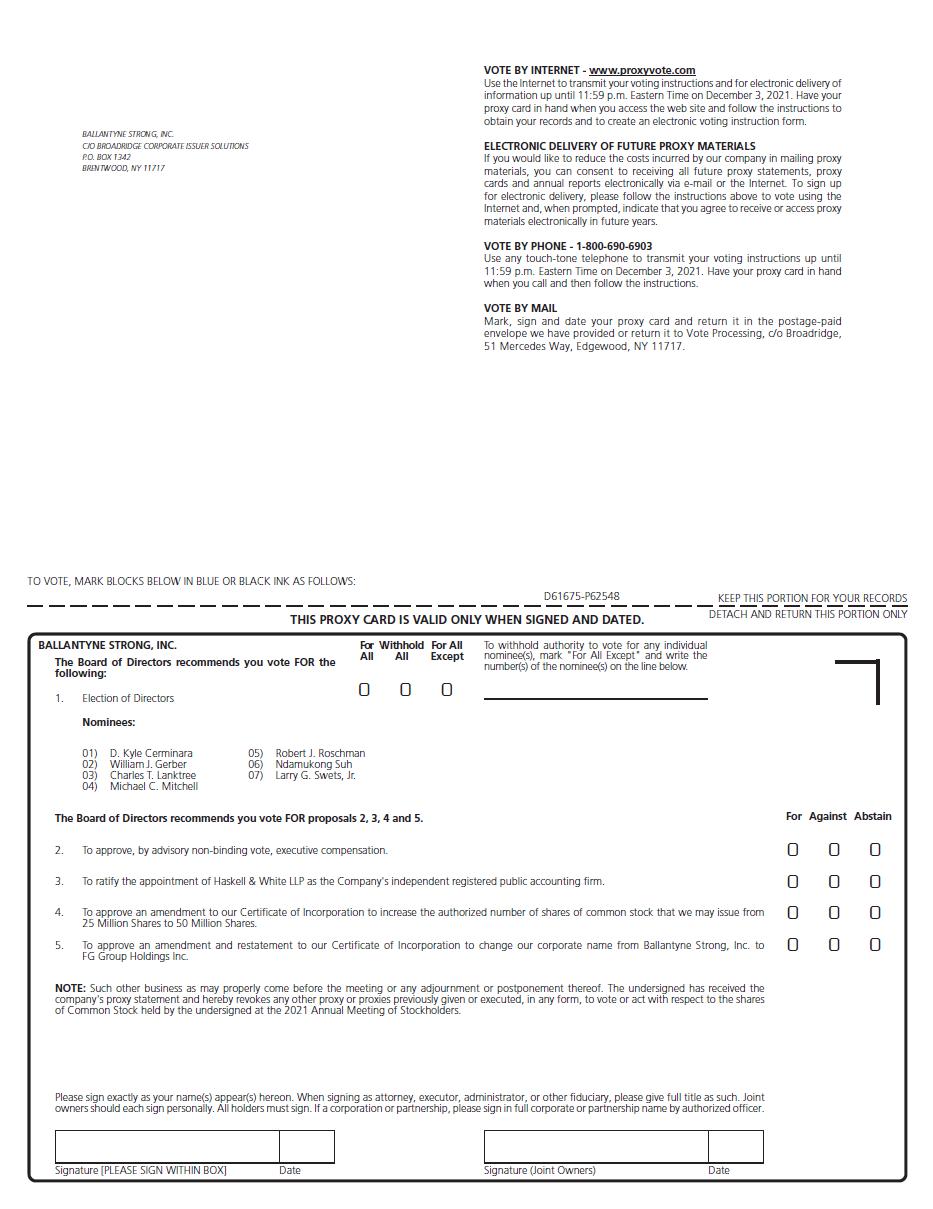

The 2021 Annual Meeting of Stockholders of Ballantyne Strong, Inc. will be held at The Westin, 400 Corporate Drive, Fort Lauderdale, FL 33334,our principal executive offices located at 4201 Congress Street, Suite 175, Charlotte, North Carolina 28209*, on May 23, 2016December 6, 2021, at 1:5:00 p.m., Local Timelocal time (including any adjournments or postponements thereof, the “Annual Meeting”), for the following purposes:

| 1. | To elect | |

| 2. | To consider and act upon a non-binding advisory resolution to approve the compensation of | |

| 3. | To ratify the appointment of | |

| 4. | To approve an amendment to our Certificate of Incorporation to increase the authorized number of shares of common stock that we may issue from 25 million shares to 50 million shares. | |

| 5. | To approve an amendment and restatement to our Certificate of Incorporation to change our corporate name from Ballantyne Strong, Inc. to FG Group Holdings Inc. | |

| 6. | To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof. |

Only those stockholders of record at the close of business on March 24, 2016 (the “Record Date”),October 13, 2021, shall be entitled to notice of, the Annual Meeting and to vote at, the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, please vote your proxy card as soon as possible to assure a quorum. Please vote in one of these three ways:

| (1) | Visit the website atwww.proxyvote.com and have your proxy card in hand to vote through the | |

| (2) | Use the toll-free telephone number listed on the proxy card, or | |

| (3) | Mark, sign, date and promptly return the enclosed proxy card in the postage-paid envelope. |

If you vote on the website or by telephone, you do not need to return a proxy card by mail, unless you wish to change your vote or revoke your vote.

Voting by any of these methods will ensure that you are represented at the Annual Meeting even if you are not there in person. Stockholders who have previously voted but attend the Annual Meeting may withdraw their proxy if they wish to do so, and vote in person.

If you desire assistance in scheduling overnight accommodations in Fort Lauderdale, contact Alison Sparrow at Ballantyne at (770) 369-9334. Early reservations are encouraged.

The formal meeting of stockholders will be followed by a review of our business. I look forward to seeing you at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 23, 2016:December 6, 2021: The Company’s Proxy Statement, its 2020 Annual Report to Stockholders, and this Notice are available atwww.strong-world.comwww.ballantynestrong.com orwww.proxyvote.com.

Dated this 28th19th day of March, 2016.October, 2021.

| By Order of the Board of Directors, | |

| |

| |

D. Kyle Cerminara Chairman |

* We intend to hold our Annual Meeting in person at the Company’s corporate office or another location nearby. However, we are actively monitoring the COVID-19 pandemic; we are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state and local governments may impose. In the event it is not possible or advisable to hold our Annual Meeting in person, or if the venue changes, we will announce such changes or alternative arrangements for the Annual Meeting as promptly as practicable, which may include postponing or adjourning the Annual Meeting or holding the Annual Meeting solely by means of remote communication. We plan to announce any such updates via a press release and posting details on our website that will also be filed with the Securities and Exchange Commission as proxy material. Please monitor our Annual Meeting website at www.ballantynestrong.com, under the tab “Investor Relations,” for updated information. If you are planning to attend our Annual Meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting.

Table of Contents

2021 Annual Meeting Proxy Statement Summary

Below are highlights of important information you will find in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Date, Time and Location of Annual Meeting | December 6, 2021, at 5:00 p.m., Eastern Time Headquarters of Ballantyne Strong, Inc. 4201 Congress Street, Suite 175, Charlotte, North Carolina 28209* |

| Management Proposals | 1. | Election of seven director nominees (all incumbent directors) to serve until Ballantyne Strong’s 2022 Annual Meeting: D. Kyle Cerminara, William J. Gerber, Charles T. Lanktree, Michael C. Mitchell, Robert J. Roschman, Ndamukong Suh, and Larry G. Swets, Jr. |

| 2. | Approve, on a non-binding advisory basis, the compensation of Ballantyne Strong’s Named Executive Officers. | |

| 3. | Ratify the appointment of Haskell & White LLP as Ballantyne Strong’s independent registered public accounting firm for the 2021 fiscal year. | |

| 4. | Approve an amendment to our Certificate of Incorporation to increase the authorized number of shares of common stock that we may issue from 25 million shares to 50 million shares. | |

| 5. | Approve an amendment and restatement to our Certificate of Incorporation to change our corporate name from Ballantyne Strong, Inc. to FG Group Holdings Inc. | |

| Our Board of Directors recommends a vote “FOR” each of these proposals. | ||

| Director Nominees | You are being asked to vote on these seven director nominees. Directors are elected by a plurality of votes cast. Detailed information about each nominee’s background and areas of expertise can be found beginning on page 9 of the Proxy Statement. |

| Committee Membership | ||||||||||||

| Name | Age as of Annual Meeting | Director Since | Principal Occupation | AC | CC | NCGC | ||||||

| D. Kyle Cerminara | 44 | 2015 | Chief Executive Officer, Co-Founder and Partner | |||||||||

| Fundamental Global | ||||||||||||

| William J. Gerber | 63 | 2015 | Former Chief Financial Officer |  |  | |||||||

| TD Ameritrade Holding Corporation | ||||||||||||

| Charles T. Lanktree | 72 | 2015 | Chief Executive Officer |  |  | |||||||

| Eggland’s Best, LLC | ||||||||||||

| Michael C. Mitchell | 41 | 2021 | Former Partner | |||||||||

| Locust Wood Capital | ||||||||||||

| Robert J. Roschman | 56 | 2015 | Owner |  |  |  | ||||||

| Triple R. Associates, Ltd. | ||||||||||||

| Ndamukong Suh | 34 | 2016 | Professional Athlete |  | ||||||||

| Tampa Bay Buccaneers of the NFL | ||||||||||||

| Larry G. Swets, Jr. | 46 | 2021 | Chief Executive Officer | |||||||||

| FG Financial Group, Inc. | ||||||||||||

| AC | Audit Committee |  Chair of the Committee Chair of the Committee | ||

| CC | Compensation Committee |  Committee Member Committee Member | ||

| NCGC | Nominating and Corporate Governance Committee |

| i |

Corporate Governance Highlights | Corporate governance matters (including director and executive officer bios) are discussed beginning on page 12 of the Proxy Statement. Some highlights include: |

| ● | Director Independence: The Board is composed of a majority of independent directors. All members of the Audit, Compensation and Nominating and Corporate Governance Committees of the Board of Directors are independent. | |

| ● | Board of Directors Leadership Structure and Role of the Board of Directors in Risk Oversight: The Proxy Statement discusses Mr. Cerminara’s role as Chairman of the Board of Directors and the oversight of risks by the Board of Directors and its standing committees. | |

| ● | Hedging and Pledging Policy: Summarizes the Company’s hedging and pledging policy. | |

| ● | Voting Standard for Election of Directors: Directors are elected by a plurality of votes cast. | |

| ● | Board of Directors Self-Evaluation and Review of Independence of Board of Directors: Annual. |

| Related Party Transactions | A summary of Ballantyne Strong’s related party transactions since January 1, 2019 can be found beginning on page 36 of the Proxy Statement. |

| Director Compensation | A summary of director compensation for the 2020 fiscal year can be found beginning on page 28 of the Proxy Statement. |

| Executive Compensation | An overview of the executive compensation program, including the compensation to executives for the 2020 and 2019 fiscal years, can be found beginning on page 18 of the Proxy Statement. |

| Proxy Solicitor | Alliance Advisors LLC. If you have any questions, require any assistance in voting your shares of the Company, need any additional copies of the Company’s proxy materials, or have any other questions, please call Alliance Advisors LLC at the following toll-free telephone number: 844-876-6187. |

* As stated in the Notice of Annual Meeting of Stockholders, we intend to hold our Annual Meeting in person at the Company’s corporate office or another location nearby. However, we are actively monitoring the COVID-19 pandemic; we are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state and local governments may impose. In the event it is not possible or advisable to hold our Annual Meeting in person, or if the venue changes, we will announce such changes or alternative arrangements for the Annual Meeting as promptly as practicable, which may include postponing or adjourning the Annual Meeting or holding the Annual Meeting solely by means of remote communication. We plan to announce any such updates via a press release and posting details on our website that will also be filed with the Securities and Exchange Commission as proxy material. Please monitor our Annual Meeting website at www.ballantynestrong.com, under the tab “Investor Relations,” for updated information. If you are planning to attend our Annual Meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting.

| ii |

PROXY STATEMENT FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2016DECEMBER 6, 2021

This Proxy Statementproxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board” or “Board of Directors”) of Ballantyne Strong, Inc. (the “Company,” “Ballantyne Strong,” “we”“we,” “our” or “us”). The 2016Company’s 2021 Annual Meeting of Stockholders (the “Annual Meeting”) will be held on May 23, 2016December 6, 2021, at 1:5:00 p.m., Local Time,local time, at the The Westin, 400 Corporate Drive, Fort Lauderdale, FL 33334.Company’s principal executive offices located at 4201 Congress Street, Suite 175, Charlotte, North Carolina 28209, which is subject to change for the public health reasons discussed below. The Company’s telephone number is (402) 453-4444.(704) 994-8279.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

to be held on May 23, 2016December 6, 2021

As permitted by the rules of the Securities and Exchange Commission’sCommission (the “SEC”), we employ the cost-effective and environmentally-conscious “notice and access” delivery method. This allows us to give our stockholders access to a full set of our proxy materials online. Beginning on or about April 8, 2016,October 26, 2021, we will send to most of our stockholders, by mail or e-mail, a notice, titled as the Notice of Electronic Availability of Proxy Materials, explaining how to access our proxy materials and vote online or by telephone.vote. This notice is not a proxy card and cannot be used to vote your shares.

On or about the same day, we will begin mailing paper copies of our proxy materials to stockholders who have requested them. Those stockholders who do not receive the Notice of Electronic Availability of Proxy Materials, including stockholders who have previously requested to receive paper copies of our proxy materials, will receive a copy of this Proxy Statement,proxy statement, the proxy card, and theour Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “Annual Report”), by mail. This noticeThe Notice of Electronic Availability of Proxy Materials also contains instructions on how you can (i) receive a paper copy of the Proxy Statement,proxy statement, proxy card and Annual Report if you only received a notice by mail, or (ii) elect to receive your Proxy Statement,proxy statement, proxy card and Annual Report over the internetInternet next year if you received them by mail this year.

The Company may deliver multiple proxy statements to multiple stockholders who have requested physical delivery of the proxy materials and who are sharing an address unless it receives contrary instructions from one or more of the stockholders. If you are a stockholder residing at a shared address and would like to request an additional copy of the proxy materials now or with respect to future mailings (or to request to receive only one copy of the proxy materials if you are currently receiving multiple copies), please send your request to the Company, Attn: Corporate Secretary at 4201 Congress Street, Suite 175, Charlotte, North Carolina 28209 or call us at (704) 994-8279.

What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will act upon the matters described in the accompanying notice of meeting.

Who may vote?is entitled to vote at the Annual Meeting?

The Company has one class of voting shares outstanding. Only stockholders of record of our common stock at the close of business on March 24, 2016, the Record Date,October 13, 2021 (the “Record Date”), are entitled to receive notice of the Annual Meeting and to vote the shares of common stock that they held on the Record Date. AtDate at the Annual Meeting. As of the close of business on March 24, 2016,October 13, 2021, the Company had 14,291,01418,475,018 shares of outstanding common stock outstanding, all of which are entitled to vote at the Annual Meeting. A list of stockholders as of the Record Date will be available for inspection during ordinary business hours at our principal executive offices located at 13710 FNB Parkway,4201 Congress Street, Suite 400, Omaha, NE 68154175, Charlotte, North Carolina 28209 for ten (10) days before the Annual Meeting. Each share of common stock will have one (1) vote on each matter to be voted on.on at the Annual Meeting. The shares of common stock held in treasury are not considered outstanding and will not be voted.

What is the purpose of the Annual Meeting?

At the Company’s Annual Meeting, stockholders will act upon the matters described in the accompanying notice of meeting. In addition, management will report on Ballantyne’s performance during fiscal 2015 and respond to questions from stockholders.

Who may attend the Annual Meeting?

All stockholders as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. If you attend the Annual Meeting in person, you will be asked to present photo identification (such as a state-issued driver’s license) and proof that you own shares of Ballantyne Strong common stock before entering the meeting. If you are a holder of record, the top half of your proxy card or your Notice of InternetElectronic Availability of Proxy Materials is your admission ticket. If you hold shares in street name (through“street name” (that is, through a bank, broker or broker, for example)other nominee), a recent brokerage statement or a letter from your broker, bank or bankother nominee showing your holdings of Ballantyne Strong common stock is proof of ownership.

| 1 |

As part of our efforts to maintain a safe and healthy environment at our Annual Meeting, we are closely monitoring statements issued by the federal, state and local authorities regarding the COVID-19 pandemic. For that reason, we reserve the right to reconsider the date, time, location, and/or means of convening the Annual Meeting, including solely by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be issued by press release, posted on our website, and filed with the SEC as additional proxy material. We also encourage attendees to review guidance from public health authorities on this issue.

What is the difference between a stockholder of record and a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Broadridge Financial Solutions, Inc., then you are a “stockholder of record.” The Notice of Electronic Availability of Proxy Materials or hard copies of our proxy materials have been provided directly to you by the Company. You may vote by ballot at the Annual Meeting or vote by proxy by completing, signing, dating and returning the enclosed proxy card (if you received hard copies of our proxy materials) or following the instructions on the proxy card for voting by Internet or telephone. If your shares are held for you in “street name,” then you are not a stockholder of record. Rather, the broker, bank or other nominee that holds your shares is the stockholder of record and you are the “beneficial owner” of the shares. The Notice of Electronic Availability of Proxy Materials or hard copies of our proxy materials, as well as a voting instruction card, have been forwarded to you by the broker, bank or other nominee. If you wantcomplete and properly sign the voting instruction card and return it in the appropriate envelope, or follow the instructions on the voting instruction card for voting by Internet or telephone, the broker, bank or other nominee will cause your shares to be voted in accordance with your instructions. If you are a beneficial owner of shares and wish to vote shares that you hold in street name in person at the Annual Meeting, then you must bringobtain a legal proxy, executed in your namefavor, from the holder of record (the broker, bank or other nominee that holds your shares.nominee).

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of the Company’s common stock outstanding onentitled to vote at the Record DateAnnual Meeting will constitute a quorum, permitting action to be taken and the conduct of business at the Annual Meeting. As of the Record Date, 14,291,01418,475,018 shares of common stock were outstanding. Broker non-votes, abstentions and proxies marked “withheld”“withhold” for the election of directors will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, butbusiness. Once a share is represented at the Annual Meeting, it will not be counteddeemed present for quorum purposes of determiningthroughout the number of votes cast with respect toAnnual Meeting (including any postponement or adjournment thereof unless a proposal.new record date is or must be set for such postponement or adjournment).

May I vote by proxy card or by telephonethe Internet or through the internet?telephone?

You may vote by proxy card or by telephonethe Internet or through the internet.telephone. Voting by any of these methods will ensure that you are represented at the Annual Meeting even if you are not there in person. Please refer to the voting instructions on the Notice of Electronic Availability of Proxy Materials and the proxy card. You may also vote by ballot at the Annual Meeting if you attend in person.

Yes. You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. In the event voting is done using the internet, the cutoff will be 11:59 P.M., Eastern Time, the day before the Annual Meeting. You may change your vote on the internetMeeting, whether submitted by mail or by telephone (only your latest internetthe Internet or telephone, by (i) delivering a signed written notice stating that you revoke your proxy submittedto the attention of the Secretary of the Company at 4201 Congress Street, Suite 175, Charlotte, North Carolina 28209 that bears a later date than the date of the proxy you want to revoke and is received prior to the Annual Meeting, will be counted)(ii) submitting a valid, later-dated proxy by the Internet or telephone before 11:59 p.m., Eastern Time, on December 3, 2021, or by signing and returning a new proxy card with a later date,mail that is received prior to the Annual Meeting, or by(iii) attending the meetingAnnual Meeting (or, if the Annual Meeting is postponed or adjourned, attending the postponed or adjourned meeting) and voting in person. However,person, which automatically will cancel any proxy previously given, or revoking your proxy in person, but your attendance alone at the Annual Meeting will not automatically revoke your proxy unlesspreviously given. If you hold your shares in “street name” through a broker, bank or other nominee, you must contact your broker, bank or other nominee to change your vote againor obtain a written legal proxy to vote your shares if you wish to cast your vote in person at the meeting or specifically request in writing that your prior proxy be revoked.Annual Meeting.

| 2 |

How does the Board recommend I vote?

Unless you give instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendation is set forth in the description of each proposal in this Proxy Statement. With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

How many votes are required to approve each Proposal?

Proposal 1—One—Election of eightseven directors named in this Proxy Statementproxy statement to the Ballantyne Strong Board of Directors, each to hold office until our 20172022 Annual Meeting of Stockholders (the “2017“2022 Annual Meeting”) and until a successor is duly elected and qualified.qualified or until the director’s earlier retirement, resignation or removal.

Under our Bylaws, the eightseven candidates receiving the highest number of“FOR” “FOR” votes cast by holders of shares represented in person or by proxy at the Annual Meeting will be elected. This number is called a plurality. A properly executed proxy cardProperly submitted proxies marked“WITHHOLD” “WITHHOLD” with respect to the election of a director nominee will be counted for purposes of determining if there is a quorum at the Annual Meeting, but will not be considered to have been voted for the director nominee. Similarly, any broker non-votes will be counted for purposes of determining if there is a quorum, but will not be considered to have been voted for the director nominee.

Proposal 2—Two—Advisory Vote on Executive Compensation.

The affirmative votenumber of a majorityvotes cast “FOR” advisory approval of the shares presentcompensation of our Named Executive Officers (as defined below), either in person or represented by proxy, at the meeting or entitled to vote will be deemed byAnnual Meeting must exceed the Board to constitute thenumber of votes cast “AGAINST” advisory vote on executive compensation.approval.

Proposal 3—Three—Ratification of Independent Auditors.Registered Public Accounting Firm.

The affirmative votenumber of a majority ofvotes cast “FOR” the shares present or represented by proxy at the meeting or entitled to vote is required to approve Proposal 3, ratification of the appointment of KPMGHaskell & White LLP as the Company’s independent auditorsregistered public accounting firm for the fiscal year ending December 31, 2016.2021, either in person or by proxy, at the Annual Meeting must exceed the number of votes cast “AGAINST” the ratification.

Proposal Four—Amendment to our Certificate of Incorporation to increase the authorized number of shares of common stock.

To be approved by our stockholders, at least a majority of the shares of common stock outstanding and entitled to vote on the proposal as of close of business on the Record Date must vote “FOR” the proposal to amend our Certificate of Incorporation to increase the authorized number of shares of common stock that we may issue from 25 million shares to 50 million shares. Abstentions will be counted toward the tabulation of votes cast on this proposal and will have the same effect as a vote “AGAINST” this proposal. There will be no broker non-votes with respect to this proposal.

Proposal Five—Amendment and Restatement to our Certificate of Incorporation to change our corporate name from Ballantyne Strong, Inc. to FG Group Holdings Inc.

To be approved by our stockholders, at least a majority of the shares of common stock outstanding and entitled to vote on the proposal as of close of business on the Record Date must vote “FOR” the proposal to amend and restate our Certificate of Incorporation to change our corporate name from Ballantyne Strong, Inc. to FG Group Holdings Inc. Abstentions will be counted toward the tabulation of votes cast on this proposal and will have the same effect as a vote “AGAINST” this proposal. There will be no broker non-votes with respect to this proposal.

Other Proposals.No other matters are anticipated to be brought before the meeting.Annual Meeting.

| 3 |

How does the Board of Directors recommend I vote?

Unless you give instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board of Directors unanimously recommends a vote “FOR”:

| 1. | Election of each of the seven director nominees named in this proxy statement to the Board of Directors until our 2022 Annual Meeting. | |

| 2. | Approval, on an advisory, non-binding basis, of the compensation of our Named Executive Officers, as described in this proxy statement. | |

| 3. | Ratification of the appointment of Haskell & White LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. | |

| 4. | Approval of an amendment to our Certificate of Incorporation to increase the authorized number of shares of common stock that we may issue from 25 million shares to 50 million shares. | |

| 5. | Approval of an amendment and restatement to our Certificate of Incorporation to change our corporate name from Ballantyne Strong, Inc. to FG Group Holdings Inc. |

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

What ishappens if I submit a broker non-vote?proxy card and do not give specific voting instructions?

If you holdare a stockholder of record and sign and return the proxy card without indicating your voting instructions, your shares will be voted in street nameaccordance with the recommendations of the Board of Directors. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion. As of the filing date of this proxy statement, we did not know of any other matter to be raised at the Annual Meeting.

If you are a beneficial owner and do not provide voting instructions to your bank, broker or other nominee, then, under applicable rules, the broker, bank or other nominee that holds your shares in “street name” may generally vote on “routine” matters but cannot vote on “non-routine” maters. If the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the broker, bank or other nominee will not be voted on any proposal on which your brokerinform the inspector of election for the Annual Meeting that it does not have discretionarythe authority to vote. In this situation,vote on the matter with respect to your shares. This is generally referred to as a “broker non-vote.”

Which voting matters are considered routine or non-routine, and what is the impact of a broker non-vote?

Proposal 1 regarding the election of directors and Proposal 2 regarding advisory approval of the compensation of our Named Executive Officers are considered non-routine matters under applicable rules. Therefore, a broker, bank or other nominee cannot vote on such proposals without voting instructions from the beneficial owners. If you do not provide voting instructions to your broker, bank or other nominee on these proposals, a “broker non-vote” occurs. Shareswill occur. Although shares constituting broker non-votes are not counted or deemed towill be present or represented for the purpose of determining whether stockholders have approved a matter, but they are counted as present for the purpose of determining a quorum at the Annual Meeting. AtMeeting, broker non-votes will not be considered as votes cast for or withheld from a director nominee or for or against Proposal 2. Accordingly, broker non-votes will have no impact on the election of directors or Proposal 2.

Proposal 3 concerning the ratification of the appointment of Haskell & White LLP as our independent registered public accounting firm for the year ending December 31, 2021, Proposal 4 regarding approval of an amendment to our Certificate of Incorporation to increase the authorized number of shares of common stock, and Proposal 5 regarding approval of an amendment and restatement of our Certificate of Incorporation to change our corporate name from Ballantyne Strong, Inc. to FG Group Holdings Inc. are considered routine matters under applicable rules. Therefore, a broker, bank or other nominee may generally vote on this matter. No broker non-votes are expected in connection with Proposal 3, Proposal 4, or Proposal 5.

| 4 |

How will abstentions be counted?

Although shares constituting abstentions will be counted as present for the purpose of determining a quorum at the Annual Meeting, brokerswithheld votes will not be considered as votes cast for Proposal 1, and abstentions will not be considered as votes cast for Proposals 2 or 3. Accordingly, because the election of directors requires only a plurality vote, withheld votes will have discretionno impact upon the election of directors, and abstentions will also have no impact on the outcome of Proposal 2 (advisory approval of say-on-pay) or Proposal 3 (ratification of the independent registered public accounting firm). Because Proposal 4 and Proposal 5 require the approval of at least a majority of the shares of common stock entitled to vote on the proposals as of close of business on the Record Date, abstentions will have the same effect as votes “AGAINST” Proposal 3, but not on Proposal 14 and Proposal 2.5.

Who pays the expenses incurred in connection with the solicitation of proxies?

The Company will bearWe have retained Alliance Advisors LLC to assist in the cost of its solicitation of proxies for the Annual Meeting and will pay Alliance Advisors LLC a fee of approximately $15,000, including reimbursement of reasonable out-of-pocket expenses and disbursements incurred in connection with the chargesproxy solicitation. It is anticipated that Alliance Advisors LLC will employ approximately 25 persons to solicit stockholders of the Company for the Annual Meeting. We have also agreed to indemnify Alliance Advisors LLC against certain losses, costs and expenses of brokers and others for forwarding solicitation materials to beneficial owners of stock.expenses. In addition, to the use of mail, proxies may be solicited on our behalf by our directors, officers or employees in person or by mail, telephone, by press releases, through internet, byfacsimile or electronic means, by facsimile and otherwise by the Company’s management at the direction of our Board of Directors, withoutcommunications, but no additional compensation.compensation will be paid to them. We have not yet retained, but may retain, a proxy solicitor in conjunction with the Annual Meeting,also requested brokerage houses and its employees may assist us in the solicitation. We will pay all costs ofother custodians, nominees and fiduciaries to forward soliciting proxies, including a feematerial to beneficial owners and reasonablehave agreed to reimburse those institutions for their out-of-pocket expenses for the proxy solicitor, if any.expenses.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting,Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amendment to the Form 8-K to publish the final results.

How may I get additional copies of the Annual Report?

Our Annual Report on(as amended by Form 10-K for the fiscal year ended December 31, 2015,10-K/A), including financial statements, is available through our website atwww.strong-world.comwww.ballantynestrong.com. The information provided on the Company’s website is referenced in this proxy statement for information purposes only. The information on the Company’s websiteonly, and shall not be deemed to be a part of or incorporated by reference into this proxy statement or any other filings the Company makes with the SEC. For a printed copy, please contact our Corporate Secretary by mail at the address listed below:at: Attn: Corporate Secretary, Ballantyne Strong, Inc., 4201 Congress Street, Suite 175, Charlotte, North Carolina 28209.

Will the Annual Meeting be held in person?

As noted above in the Notice, we intend to hold our Annual Meeting in person. However, we are actively monitoring the COVID-19 pandemic; we are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state and local governments may impose. In the event it is not possible or advisable to hold our Annual Meeting in person, we will announce alternative arrangements for the Annual Meeting as promptly as practicable, which may include postponing or adjourning the Annual Meeting or holding the Annual Meeting solely by means of remote communication. We plan to announce any such updates via a press release and posting details on our website that will also be filed with the Securities and Exchange Commission as proxy material. Please monitor our Annual Meeting website at www.ballantynestrong.com, under the tab “Investor Relations,” for updated information. If you are planning to attend our Annual Meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

Largest Owners of Ballantyne Strong Shares

The following table shows each person or entity that Ballantyne Strong knows to be the beneficial owner of more than five percent of the Company’sBallantyne Strong’s outstanding common stock as of the close of business on the Record Date of March 24, 2016.October 13, 2021.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Class(2) | ||||||

| Fundamental Global GP, LLC 108 Gateway Boulevard, Suite 204 Mooresville, NC 28117 | 5,836,402 | (3) | 31.6 | % | ||||

| Dimensional Fund Advisors LP 6300 Bee Cave Road, Building One Austin, TX 78746 | 972,439 | (4) | 5.3 | % | ||||

| (1) | This information is based on |

| (2) | Based upon |

| (3) | |

| (4) | Dimensional reported that it has |

| |

| 6 |

Share Ownership of Directors, Director Nominees and Executive Officers

The following chart sets forth, as of the close of business on the Record Date of March 24, 2016,October 13, 2021, certain information concerning beneficial ownership of common stock by each director and director nominee of the Company, each of the named executive officers (as defined below),Named Executive Officers, and all current directors and executive officers as a group. The address for each director, director nominee and executive officer listed is: c/o Ballantyne Strong, Inc., 4201 Congress Street, Suite 175, Charlotte, North Carolina 28209.

| Name | Number of Shares Beneficially Owned(1) | Percent of Common Stock(2) | ||||||

| D. Kyle Cerminara, Chairman and CEO | 2,402,027 | (3) | 16.8 | % | ||||

| Nathan D. Legband, Senior Vice President, CFO, and Treasurer | 8,000 | (4) | * | |||||

| Stephen L. Schilling, President of Digital Media | 35,500 | (5) | * | |||||

| Ray F. Boegner, President of Cinema | 97,697 | (6) | * | |||||

| Samuel C. Freitag, Director | 267,480 | (7) | 1.9 | % | ||||

| Marc E. LeBaron, Director | 52,361 | (8) | * | |||||

| James C. Shay, Director | 35,561 | (9) | * | |||||

| Charles T. Lanktree, Director | 14,151 | (10) | * | |||||

| Robert J. Marino, Director | 11,651 | (11) | * | |||||

| Robert J. Roschman, Director | 19,451 | (12) | * | |||||

| William J. Gerber, Director | 6,651 | (13) | * | |||||

| Ndamukong Suh, Director | 7,625 | (14) | * | |||||

| Lewis M. Johnson, Director Nominee | 2,288,048 | (17) | 16.0 | % | ||||

| Gary L. Cavey, Former President and CEO | 21,276 | (15) | * | |||||

| Christopher D. Stark, Former President | - | * | ||||||

| David G. Anderson, Former Senior Vice President, General Counsel and Secretary | 14,900 | (16) | * | |||||

| All directors and executive officers as a group (13 persons) | 2,964,806 | (18) | 20.7 | % | ||||

| Name | Number of Shares Beneficially Owned(1) | Percent of Common Stock(2) | ||||||

| Mark D. Roberson, Chief Executive Officer | 137,279 | (3) | * | |||||

| Todd R. Major, Chief Financial Officer | 25,711 | (4) | * | |||||

| Ray F. Boegner, President of Strong Entertainment | 310,866 | (5) | 1.7 | % | ||||

| D. Kyle Cerminara, Chairman | 5,200,111 | (6) | 28.1 | % | ||||

| William J. Gerber, Director | 67,248 | (7) | * | % | ||||

| Charles T. Lanktree, Director | 72,261 | (8) | * | % | ||||

| Michael C. Mitchell, Director | 111 | (9) | * | |||||

| Robert J. Roschman, Director | 76,661 | (10) | * | % | ||||

| Ndamukong Suh, Director | 63,247 | (11) | * | % | ||||

| Larry G. Swets, Jr., Director | 50,000 | (12) | * | |||||

| All current directors and executive officers as a group (10 persons) | 6,003,495 | (13) | 32.1 | % | ||||

| * | Less than 1% of common stock outstanding. |

| (1) | Each director, director nominee and | |

| (2) | Based upon | |

| (3) | Includes | |

| (4) | Includes 23,711 shares of common stock directly owned by Mr. Major and 2,000 purchasable pursuant to stock options exercisable within 60 days of the Record Date. Does not include (i) 10,000 shares potentially issuable upon the vesting of RSUs granted on May 31, 2019, (ii) 13,334 shares potentially issuable upon the vesting of RSUs granted on October 9, 2020, and (iii) 8,000 shares potentially issuable upon the exercise of stock options granted on October 9, 2020. | |

| (5) | Includes 200,866 shares of common stock directly owned by Mr. Boegner and 110,000 shares purchasable pursuant to stock options exercisable within 60 days of the Record Date. Does not include (i) 13,334 shares potentially issuable upon the vesting of RSUs granted on June 6, 2019, (ii) 20,000 shares potentially issuable upon the vesting of RSUs granted on October 9, 2020, (iii) 8,000 shares potentially issuable upon the exercise of stock options granted on February 28, 2017, (iv) 20,000 shares potentially issuable upon the exercise of stock options granted on January 26, 2018, (v) 12,000 shares potentially issuable upon the exercise of stock options granted on June 6, 2019, and (vi) 12,000 shares potentially issuable upon the exercise of stock options granted on October 9, 2020. |

| 7 |

(6) | Includes 299,678 shares of common stock directly owned by Mr. Cerminara, | |

| (7) | Includes | |

| (8) | Includes | |

| (9) | Includes | |

| (10) | Includes | |

| Includes | ||

| (12) | Includes | |

| (13) | Includes | |

| 8 |

ELECTION OF DIRECTORS

Pursuant to the proxy contest settlement agreement entered into with Fundamental Global Investors, LLC, the largest stockholder of the Company, and its affiliates (collectively, “Fundamental Global”), on April 21, 2015, the Company expanded its Board of Directors to nine directors and nominated five director candidates from Fundamental Global’s slate of directors (Messrs. D. Kyle Cerminara, William J. Gerber, Charles T. Lanktree, Robert J. Marino and Robert J. Roschman), who were elected at the Company’s 2015 Annual Meeting of Stockholders (the “2015 Annual Meeting”). Fundamental Global holds approximately 22.2% of the Company’s outstanding shares of common stock. Mr. Cerminara, the Chief Executive Officer, Co-Founder and Partner of Fundamental Global Investors, LLC, serves as our Chairman and Chief Executive Officer. As a result of its ownership position and Mr. Cerminara’s board and management positions with the Company, Fundamental Global has the ability to exert significant influence over our policies and affairs, including the power to impact the election of our directors, appointment of our management and approval of any action requiring a stockholder vote, such as amendments to our certificate of incorporation, bylaws, significant stock issuances, mergers and asset sales.

PROPOSAL ONE

ELECTION OF DIRECTORS

Ballantyne’sBallantyne Strong’s Certificate of Incorporation, as amended (the “Certificate of Incorporation”), and Bylaws, as amended (the “Bylaws”), provide for the annual election of all directors. The Certificate of Incorporation and Bylaws allow the Board of Directors to set the number of directors from time to time and to appoint directors between Annual Meetings. For purposes of this 2016 Annual Meeting, theThe Board of Directors has set the number of directors at eight as of the Annual Meeting.seven.

AtDuring 2020, the 2015 Annual Meeting, stockholders elected nineBoard of Directors was comprised of seven directors, namely Gary L. Cavey, D. Kyle Cerminara, Marc E. LeBaron, Samuel C. Freitag, James C. Shay,Lewis M. Johnson, William J. Gerber, Colonel Jack H. Jacobs, Charles T. Lanktree, Robert J. MarinoRoschman, and Robert J. Roschman. Effective May 8, 2015, Mr. CaveyNdamukong Suh, all of whom were elected at the 2020 Annual Meeting of Stockholders held on November 30, 2020 (with the exception of Colonel Jacobs who resigned from the Board of Directors. Ndamukong Suh wasDirectors on October 5, 2020). Mr. Johnson resigned from the Board of Directors on March 9, 2021. Michael C. Mitchell and Larry G. Swets, Jr. were appointed to serve as a director effective January 18, 2016. Robert J. Marino and Marc E. LeBaron are not being renominated for re-election at the Annual Meeting. The Board is also nominating Lewis M. Johnson for election to the Board.

Our Board recommends a vote “FOR” the election of all the nominees listed below.

BOARD OF DIRECTORSDirectors on October 4, 2021.

Set forth below is a list of the eight director nomineesseven current directors of the Company, each of whom is nominated for electionre-election at the Annual Meeting, and certain information regarding them.them, including their age as of the Annual Meeting. The information below also sets forth the year in which each current director became a director of the Company. Each director nominee, if elected, will be entitled to serve until the 20172022 Annual Meeting and until a successor is duly elected and qualified.qualified or until his earlier retirement, resignation or removal.

D. Kyle Cerminara, age 38,44, has beenserved as a director of Ballantyne Strong since February 2015 and the Chairman of the Company’s Chairman, CEO and a directorBoard of Directors since May 2015. Mr. Cerminara is alsopreviously served as the Company’s Chief Executive Officer Co-Founderfrom November 2015 to April 2020. Mr. Cerminara has over 20 years’ experience as an institutional investor, asset manager, director, chief executive, founder and Partneroperator of multiple financial services and technology businesses. Mr. Cerminara co-founded Fundamental Global Investors, LLC, an SEC registered investment advisor that manages equity and fixed income hedge funds andin 2012, which is the largest stockholder of the Company. In addition,Company, and serves as its Chief Executive Officer. Mr. Cerminara is Co-Chief Investment Officera member of Capital Wealth Advisors,the board of directors of a wealth advisornumber of companies focused in the reinsurance, investment management, technology and multi-family office affiliated withcommunication sectors. These include FG Financial Group, Inc. (Nasdaq: FGF) (formerly known as 1347 Property Insurance Holdings, Inc.), which operates as a diversified reinsurance and investment management company, since December 2016; Aldel Financial Inc. (NYSE: ADF), a special purpose acquisition company co-sponsored by Fundamental Global, Investors, LLC. Inwhich has entered into a definitive business combination agreement with Hagerty, a leading specialty insurance provider focused on the global automotive enthusiast market, since April 2021; BK Technologies Corporation (NYSE American: BKTI), a provider of two-way radio communications equipment, since July 2015; and Firefly Systems Inc., a venture- backed digital advertising company, since August 2020. He has also served as President of FG New America Acquisition II Corp., a special purpose acquisition company in the process of going public and focused on merging with a company in the InsureTech, FinTech, broader financial services and insurance sectors since February 2015, he2021. From July 2020 to July 2021, Mr. Cerminara served as Director and President of FG New America Acquisition Corp. (NYSE: FGNA), a special purpose acquisition company, which merged with OppFi Inc. (NYSE: OPFI), a leading financial technology platform that powers banks to help everyday consumers gain access to credit. Mr. Cerminara was also appointed toChairman of FG Financial Group, Inc. in May 2018. He served on the Board of Directors of GreenFirst Forest Products Inc. (TSXV: GFP) (formerly Itasca Capital Ltd.), a public company focused on investments in the Company.forest products industry, from June 2016 to October 2021 and was also appointed Chairman from June 2018 to June 2021. Mr. Cerminara haswas also the Chairman of BK Technologies Corporation from March 2017 until April 2020. He also served on the Board of Directors of RELM Wireless Corporation,Limbach Holdings, Inc. (Nasdaq: LMB), a publicly traded company onwhich provides building infrastructure services, from March 2019 to March 2020; Iteris, Inc. (Nasdaq: ITI), a publicly-traded, applied informatics company, from August 2016 to November 2017; Magnetek, Inc., a publicly-traded manufacturer, in 2015; and blueharbor bank, a community bank, from October 2013 to January 2020. He served as a Trustee and President of StrongVest ETF Trust, which was an open-end management investment company, from July 2016 to March 2021. Previously, Mr. Cerminara served as the NYSE MKT, since July 2015.Co-Chief Investment Officer of CWA Asset Management Group, LLC, a position he held from January 2013 to December 2020. Prior to co-founding Fundamental Global Investors, LLC and partnering with Capital Wealth Advisors,these roles, Mr. Cerminara was a Portfolio Managerportfolio manager at Sigma Capital Management, an independent financial adviser, from 2011 to 2012, a Directordirector and Sector Headsector head of the Financials Industry at Highside Capital Management from 2009 to 2011, and a Portfolio Managerportfolio manager and Directordirector at CR Intrinsic Investors from 2007 to 2009. Before joining CR Intrinsic Investors, Mr. Cerminara was a Vice President, Associate Portfolio Managervice president, associate portfolio manager and Analystanalyst at T. Rowe Price (Nasdaq: TROW) from 2001 to 2007, where he was named amongst Institutional Investor’s Best of the Buy Side Analysts in November 2006, and an Analystanalyst at Legg Mason from 2000 to 2001. Mr. Cerminara received an MBA degree from the Darden Graduate School of Business at the University of Virginia and a B.S. in Finance and Accounting from the Smith School of Business at the University of Maryland, where he was a member of Omicron Delta Kappa, an NCAA Academic All American and Co-Captain of the men’s varsity tennis team. He also completed a China Executive Residency at the Cheung Kong Graduate School of Business in Beijing, China. Mr. Cerminara holds the Chartered Financial Analyst (CFA) designation. Mr. Cerminara brings to the Board of Directors the perspective of one of the Company’s most significant stockholders.largest stockholder. He also has extensive experience in the financial industry, including investing, capital allocation, finance and financial analysis of public companies, that qualifies him to serve onand operational experience as our Board of Directors.

Samuel C. Freitag, age 60, has been an independent private investor since January of 2004. From July 2002 to December 2003, he was President of McCarthy Capital Corporation, a private equity fund manager of approximately $300 million in capital. From 1986 until 1997, he held various positions with George K. Baum Merchant Bank, LLC, including serving as Senior Managing Director and Director, Investment Banking. Mr. Freitag has served as a director of Ballantyne since June 2011. Mr. Freitag’s investment banking experience and service on other boards of directors provide him the executive experience and knowledge toformer Chief Executive Officer, which qualify him to serve on our Board of Directors.

| 9 |

William J. Gerber, age 58,63, has served as a director of Ballantyne Strong since May 2015. Mr. Gerber served as Chief Financial Officer of TD Ameritrade Holding Corporation (TD Ameritrade)(Nasdaq: AMTD) (“TD Ameritrade”), a provider of securities brokerage services and related technology-based financial services to retail investors, traders and independent registered investment advisors, from October 2006 to October 2015. In May 2007, he was named Executive Vice President of TD Ameritrade. In his role as Chief Financial Officer, he oversaw investor relations, business development, certain treasury functions and finance operations, including accounting, business planning and forecasting, external and internal reporting, tax and competitive intelligence. From May 1999 until October 2006, he served as the Managing Director of Finance at TD Ameritrade, during which time he played a significant role in evaluating merger and acquisition opportunities. Prior to joining TD Ameritrade, he served as Vice President of Acceptance Insurance Companies, Inc. (“Acceptance”), where he was responsible for all aspects of mergers and acquisitions, investment banking activity, banking relationships, investor communications and portfolio management. Prior to joining Acceptance, Mr. Gerber spent eight years with Coopers & Lybrand, now known as PricewaterhouseCoopers, serving as an audit manager primarily focusing on public company clients. Mr. Gerber was named to Institutional Investor Magazine’s All-America Executive Team as one of the top three CFOs in the Brokerage, Asset Managers and Exchanges category (2012 2013 and 2014)2013). He was also named a member of the CNBC CFO Council (2013 and 2014). He servesSince January 2017, he has served on the Board of Directors for CTMGof Northwestern Mutual Series Fund, Inc. and Boys Town National Board of Trustees., a mutual fund company. He has also served on the Board of Directors of the U.S. holding company for the Royal Bank of Canada since July 2016 and Streck, Labs, Inc., a privately held company, since March 2015. He previously served on the Boys Town National Board of Trustees and the Board of Directors for CTMG Inc., a privately held pharmaceutical testing company. Mr. Gerber holds a B.B.A. in Accounting from the University of Michigan. Mr. Gerber is also a CPACertified Public Accountant in the State of Michigan. Mr. Gerber has served as a director of the Company since May 2015. Mr. Gerber has served as Executive Vice President and Chief Financial Officer of TD Ameritrade, an online brokerage business, for more than eight years and has extensive financial experience, bringing valuable skills to our Board of Directors.

Charles T. Lanktree, age 66,72, has served as President anda director of Ballantyne Strong since May 2015. Mr. Lanktree has served as Chief Executive Officer of Eggland’s Best, LLC, a joint venture between Eggland’s Best, Inc. and Land O’Lakes, Inc. and one of the leading distributors of freshdistributing nationally branded eggs, since 2012.2012 and also served as its President from 2012 to 2018. Since 1997, Mr. Lanktree has served as President and Chief Executive Officer of Eggland’s Best, Inc., a franchise-driven consumer egg business, where he previously served as the President and Chief Operating Officer from 1995 to 1996 and Executive Vice President and Chief Operating Officer from 1990 to 1994. Mr. Lanktree currently serves on the Board of Directors of Eggland’s Best, Inc. and several of its affiliates. He has also served on the board of directors of BK Technologies Corporation (NYSE American: BKTI), a holding company with a wholly-owned operating subsidiary that manufactures high-specification communications equipment, since March 2017. From 20092010 to 2013, he served on the Board of Directors of Eurofresh Foods, Inc., a privately held company.company, and, from 2004 to 2013, he was on the Board of Directors of Nature’s Harmony Foods, Inc. Prior to joining Eggland’s Best, Inc., Mr. Lanktree served as the President and Chief Executive Officer of American Mobile Communications, Inc. from 1987 to 1990 and as the President and Chief Operating Officer of Precision Target Marketing, Inc. from 1985 to 1987. From 1976 to 1985, he held various executive-level marketing positions with The Grand Union Company and Beech-Nut Foods Corporation. Mr. Lanktree received an MBA from the University of Notre Dame and a B.S. in Food Marketing from St. Joseph’s College. He also served in the U.S. Army and U.S. Army Reserves from 1971 to 1977. Mr. Lanktree’s 25 years of experience in consumer marketing and retail operations and his extensive experience as a Chief Executive Officer, coupled with his knowledge and insight of the retail industry, including distribution and franchising operations, qualifies him to serve on our Board of Directors.

Michael C. Mitchell, age 41, has served as a director of Ballantyne Strong since October 2021. Mr. Mitchell most recently served as a Partner at Locust Wood Capital, which he retired from in 2019 after nine years with the firm in analytical positions in the consumer, industrial, real estate and media industries. From 2006 to 2011, Mr. Mitchell was a senior analyst at Breeden Capital LP, working with former SEC Chairman Richard C. Breeden, where Mr. Mitchell was primarily focused on consumer business and was actively involved in board engagements at Applebee’s, a then-Nasdaq-listed restaurant operating company and franchisor and Zale Corporation, a then-NYSE-listed leading specialty retailer of fine jewelry as an advisor to the board. From 2005 to 2006, Mr. Mitchell worked as an analyst for Kellogg Capital Group, LLC, the private investment firm founded by Peter Kellogg, From 2004 to 2005, Mr. Mitchell served as an equity research analyst at Jefferies and Company, Inc. covering post-reorganization equities. Mr. Mitchell is currently the Chief Operating Officer of Children’s Eye Care of Northern Colorado, P.C., a Pediatric Ophthalmology practice based in Fort Collins, CO, which he cofounded and operates with his wife Dr. Carolyn G. Mitchell. Additionally, Mr. Mitchell serves on the advisory board of the Michael F. Price College of Business at the University of Oklahoma. Mr. Mitchell received an MBA from the Michael F. Price College of Business at the University of Oklahoma and a B.S. in Marketing from the Spears College of Business at Oklahoma State University. We believe Mr. Mitchell is qualified to serve on our Board of Directors as he offers the Board valuable insights obtained through his extensive experience in the financial industry, including investing, capital allocation, finance and financial analysis of public companies.

| 10 |

Robert J. Roschman, age 50,56, has served as a director of Ballantyne Strong since May 2015. Mr. Roschman has been an owner of Triple R. Associates, Ltd., a real estate firm with over 100 properties leased to fast food, distribution and retail tenants, since 1992. Mr. Roschman also holds ownership interests in several development properties throughout Florida. Mr. Roschman currently servespreviously served on the Board of Directors of Giant Bank Holdings, Inc., a privately held federally chartered bank with an Internet division, which he founded in 1998.1998 and which merged into Home BancShares, Inc. (Nasdaq: HOMB) in February 2017. From 1987 to 2000, Mr. Roschman was a Co-Founder and Vice President of Snapps Restaurants, Inc., a 76-store fast food restaurant which merged into Rally’s Hamburgers, Inc. From 1983 until 1997, he served as a shareholder of Charter Bank in Delray Beach, Florida, which merged into Southtrust Bank in 1997. Mr. Roschman received a B.S. from Florida State University. He has served as a director of the Company since May 2015. Mr. Roschman brings over 30 years of experience as an investor in multiple lines of business, including real estate, franchising, distribution, banking and retail. Mr. Roschman’s extensive experience as an investor and in managing and overseeing multiple businesses is valuable for evaluating strategic opportunities and qualifies him to serve on our Board of Directors.

James C. Shay, age 52, is the Executive Vice President and Chief Financial Officer for Hallmark Cards, Inc., a retailer of greeting cards and gifts, which position he has held since January 2016. Prior to that, he was Executive Vice President – Finance at Hallmark since August 2015. Previously, Mr. Shay served as Senior Vice President, Finance and Strategic Planning, and Chief Financial Officer for Great Plains Energy, Inc. (NYSE: GXP), a public utility holding company, and Kansas City Power & Light Company, an electric utility company, from 2010 to 2015, Chief Financial Officer for Northern Power Systems from 2009 to 2010, Managing Director of Frontier Investment Bank from 2007 to 2009, Chief Financial Officer for Machine Laboratory, LLC (after its acquisition from BOA) from 2004 to 2006 and in various positions with BHA from 1992 until its acquisition of Machine Laboratory LLC in 2004. Mr. Shay is a Certified Public Accountant. Mr. Shay has served as a director of Ballantyne since May 2012. He is also a member of the Board of Directors of Crown Media Holdings, Inc. (NASDAQ: CRWN), the MRI Global Board of Trustees and its Finance and Audit Committee, the University of Kansas School of Business Advisory Board and the University of Kansas Hospital Advancement Board. Mr. Shay’s extensive background in finance and accounting as well as his executive experience qualify him to serve on our Board of Directors.

Ndamukong Suh, age 29,34, has served as a director of Ballantyne Strong since January 2016. Mr. Suh is an independent private investor. Mr. Suhinvestor and holds ownership interests in several real estate development projects across Michigan, Nebraska, Oregon and Colorado. Mr. Suh is the Founder and a director of the Ndamukong Suh Family Foundation. He is also a professional athlete and has been a member of the Tampa Bay Buccaneers of the National Football League (“NFL”) since 2019, becoming a Super Bowl champion in February 2021. He previously was with the NFL’s Los Angeles Rams from 2018 to 2019, Miami Dolphins from 2015 to 2017 and Detroit Lions from 2010 to 2014. He currently serves on the Board of Advisors of Ember Technologies, a privately held manufacturer and designer of patented temperature adjustable dishware and drinkware. Mr. Suh holds a Bachelor’s degree in Engineering focused on Construction Management from the University of Nebraska. Mr. Suh has served as a director of Ballantyne since January 2016. Our Board of Directors believes that Mr. Suh’s well cultivated business and personal network will addadds unique value to the Company, now and into the future, which, coupled with his extensive experience as an investor, allowingallows him to evaluate strategic opportunities and qualifies him to serve on our Board of Directors.

Lewis M. JohnsonLarry G. Swets, Jr., age 46, has served as a director of Ballantyne Strong since October 2021. Mr. Swets has served as the Chief Executive Officer of FG Financial Group, Inc. (Nasdaq: FGF) (“FG Financial”), a diversified reinsurance, investment management and real estate holding company, since November 2020, after having served as Interim CEO from June 2020 to November 2020. Mr. Swets founded Itasca Financial LLC (“Itasca Financial”), an advisory and investment firm, in 2005 and has served as its managing member since inception. Mr. Swets is a member of the board of directors of FG Financial since November 2013; GreenFirst Forest Products Inc. (TSXV: GFP) (“GreenFirst”), a public company focused on investments in the forest products industry, since June 2016; Harbor Custom Development, Inc. (Nasdaq: HCDI) since February 2020; Insurance Income Strategies Ltd. since October 2017; Alexian Brothers Foundation since March 2018; and Unbounded Media Corporation since June 2019. Previously, Mr. Swets served as a Director and Chief Executive Officer of FG New America Acquisition Corp. (NYSE: FGNA), a special purpose acquisition company which merged with OppFi Inc. (NYSE: OPFI), a leading financial technology platform that powers banks to help everyday consumers gain access to credit, from July 2020 to July 2021. Mr. Swets served as Chief Executive Officer of GreenFirst from June 2016 to June 2021. Mr. Swets served as the Chief Executive Officer of Kingsway Financial Services Inc. (NYSE: KFS) (“Kingsway”) from July 2010 to September 2018, including as its President Co-Founderfrom July 2010 to March 2017. He served as Chief Executive Officer and Partnera director of Fundamental Global Investors, LLC,1347 Capital Corp., a special purpose acquisition company, from April 2014 to July 2016 when the company completed its initial business combination to form Limbach Holdings, Inc. (Nasdaq: LMB) (“Limbach”). Mr. Swets also previously served as a member of the board of directors of Limbach from July 2016 to August 2021; Kingsway from September 2013 to December 2018; Atlas Financial Holdings, Inc. (Nasdaq: AFH) from December 2010 to January 2018; FMG Acquisition Corp. (Nasdaq: FMGQ) from May 2007 to September 2008; United Insurance Holdings Corp. from 2008 to March 2012; and Risk Enterprise Management Ltd. from November 2007 to May 2012. Prior to founding Itasca Financial, Mr. Swets served as an SEC registered investmentinsurance company executive and advisor, that manages equityincluding the role of director of investments and fixed income hedge funds and is the largest stockholder of the Company. In addition,portfolio manager for Lumbermens Mutual Casualty Company, formerly known as Kemper Insurance Companies. Mr. Johnson is Co-Chief Investment Officer of Capital Wealth Advisors, a wealth advisor and multi-family office affiliated with Fundamental Global Investors, LLC. Prior to co-founding Fundamental Global Investors, LLC and partnering with Capital Wealth Advisors, Mr. Johnson was a private investor from 2010 to 2012. From 2008 to 2010 Mr. Johnson served as Portfolio Manager and Managing Director at Louis Dreyfus Highbridge Energy. Previously Mr. Johnson was a Senior Vice President, Portfolio Manager and Analyst at Pequot Capital from 2006 to 2007. Prior to joining Pequot Capital, he was a Vice President and Analyst at T. Rowe Price from 2000 to 2006. He workedSwets began his career in insurance as an Analyst at Capital Research and Managementintern in the Kemper Scholar program in 1994. Mr. Swets earned a Master’s Degree in Finance from DePaul University in 1999 and a Vice President at AYSABachelor’s Degree from 1992 to 1998. Mr. Johnson received an MBA from the Wharton School of Business at theValparaiso University of Pennsylvania in addition to a MA in Political Science and a BA in International Studies from Emory University, where he graduated Magna Cum Laude and was1997. He is a member of Phi Beta Kappa.the Young Presidents’ Organization and holds the Chartered Financial Analyst (CFA) designation. Mr. Johnson hasSwets’ 25 years of experience within financial services and extensive financial experience in the financial industry, including investing, capital allocation, finance and financial analysis of public companies, which skills would be valuablequalifies him to serve on our Board of Directors.

CORPORATE GOVERNANCE

The Board of Directors unanimously recommends a vote “FOR” the election of each of the director nominees listed above.

| 11 |

The Board of Directors operates pursuant to the provisions of the Company’s Certificate of Incorporation (as amended) and Bylaws (as amended) and has also adopted several corporate governance policies to address significant corporate governance issues. Our Code of Ethics, Audit Committee Charter, Nominating and Corporate Governance Committee Charter, and Compensation Committee charterCharter are available on our website atwww.strong-world.comwww.ballantynestrong.com .under the tab “Investor Relations” and then the “Corporate Governance” tab.

Board Leadership Structure and Role of the Board in Risk Oversight

D. Kyle Cerminara is the Chairman of the Company’s Board of Directors and former Chief Executive Officer. Mr. Cerminara is the Chief Executive Officer and Chairmanco-founder of the Board of Directors. Mr. Cerminara representsFundamental Global, the Company’s largest stockholder, which, represents 22.2%together with its affiliates, held approximately 29.5% of the voting and economic interest.interest in the Company as of the Record Date. As such, heMr. Cerminara may be deemed to be the Company’s controlling stockholder. It is

Prior to April 13, 2020, Mr. Cerminara’s opinion that a controlling stockholder who is active in the business,Cerminara served as is currently the case, should hold both roles, setting the toneChairman and Chief Executive Officer of the organization, having the ultimate responsibility for all of the Company’s operating and strategic functions, and providing unified leadership and direction toCompany, which the Board of Directors believed was the best leadership structure for us and our stockholders at the Company’s executive management. The opinion is shared bytime. On April 13, 2020, Mr. Cerminara resigned from his position as our Chief Executive Officer, while continuing to serve as Chairman of the Board of Directors. The Board believed separating the roles of Chairman of the Board and Chief Executive Officer at this time was in our and our stockholders’ best interests, as it allowed Mark Roberson, our new Chief Executive Officer, to focus his time and energy on the day-to-day management of the business, while our Chairman of the Board could focus on providing advice and oversight of management. In connection with Mr. Cerminara’s resignation as Chief Executive Officer, the Board also established a Co-Chairman of the Board position, held by Lewis Johnson, which was subsequently eliminated when Mr. Johnson resigned from the Board of Directors has not named a lead independent director, but receives strong leadership from allon March 9, 2021.

We believe it is beneficial to separate the roles of its members. OurChairman of the Board committees consist of only independent members, and our independent directors meet at least annually in executive session without the presence of non-independent directors and management. In addition, our directors take active and substantialChief Executive Officer to facilitate their differing roles in the activitiesleadership of our company. The role of the Chairman includes setting the agenda for, and presiding over, all meetings of our Board, atincluding executive sessions of independent directors, providing input regarding information sent to our Board, serving as liaison between the full board meetings. They are able to propose items for board meeting agendas,CEO and the Board’s meetings include timeindependent directors and directors and providing advice and assistance to the CEO. The Chairman is also a key participant in establishing performance objectives and overseeing the process for discussionthe annual evaluation of items not onour CEO’s performance. In contrast, our CEO is responsible for handling our day-to-day management and direction, serving as a leader to the formal agenda. Ourmanagement team and formulating corporate strategy.

Mr. Roberson serves as Chief Executive Officer while Mr. Cerminara is currently the non-executive Chairman of the Board. The Board has historically sought to ensure that a majority of its members are independent. The Board believes that this open structure as comparedis appropriate for the Company and provides the appropriate level of independent oversight necessary to a systemensure that the Board meets its fiduciary obligations to our stockholders, that the interests of management and our stockholders are properly aligned, and that we establish and follow sound business practices and strategies that are in which therethe best interests of our stockholders.

The Board of Directors does not believe that one particular leadership structure is a designated lead independent director, facilitates a greater sense of responsibility among our directorsappropriate at all times and facilitates active and effective oversight bywill continue to evaluate the independent directors of the Company’s operations and strategic initiatives, including any risks.Board’s leadership structure from time to time.

| 12 |

One of the Board’sBoard of Directors’ key functions is informed oversight of the Company’s risk management process. The Board of Directors does not have a standing risk management committee, but rather administers this oversight function directly through the Board of Directors as a whole, as well as through various Board standing committees of the Board of Directors that address risks inherent in their respective areas of oversight. In particular, the Board of Directors is responsible for monitoring and assessing strategic and operational risk exposure.exposure, which may include financial, legal and regulatory, human capital, information technology and security and reputation risks. The Audit Committee has the responsibility to consider and discuss major financial risk exposures and the steps management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also provides oversight of the performance of the internal audit function. The Nominating and Corporate Governance Committee monitors the effectiveness of the Company’s corporate governance guidelinespolicies and the selection of prospective members of the Board membersof Directors and their qualifications.qualifications, as well as environmental, social and governance (“ESG”)-related risks. The Compensation Committee, in conjunction with the Audit Committee, assesses and monitors whether any of the Company’s compensation policies and programs have the potential to encourage excessive risk-taking. In addition, the Compensation Committee reviews and monitors matters related to human capital management, including diversity and inclusion initiatives and management of human capital risks. Like all businesses, we also face threats to our cybersecurity, as we are reliant upon information systems and the Internet to conduct our business activities. In light of the pervasive and increasing threat from cyberattacks, the Board believes oversight of this risk is appropriately allocated to the Audit Committee. The Audit Committee, with input from management, assesses the Company’s cybersecurity risks and the measures implemented by the Company to mitigate and prevent cyberattacks and respond to data breaches, and periodically reports on the Company’s cybersecurity program to the Board of Directors. In addition, management and the Board of Directors have recently focused on risks relating to, and the impact on the Company from, the COVID-19 pandemic, and will continue to do so while the situation remains in flux.

Typically, the entire Board of Directors meets with management and the applicable committees of the Board committeesof Directors at least annually to evaluate and monitor respective areas of oversight. Both the Board of Directors as a whole and the various standing committees receive periodic reports from individuals responsible for risk management, as well as incidental reports as matters may arise. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board of Directors as quickly as possible. The Board’sBoard of Directors’ role in risk oversight does not affect the Board’sits leadership structure. However, our Board’s leadership structure supports such risk oversight by combining the Chairman position with the Chief Executive Officer position, the person with primary corporate responsibility for risk management.

The Board of Directors is composed of a majority of independent directors as defined by the listing requirements of the NYSE MKT.American. The Board of Directors has determined that Messrs. LeBaron, Freitag, Shay, Gerber, Lanktree, Roschman Marino and Suh are independent directors of the Company and Mr. Johnson qualifies as an independent director, if elected, under the listing standards adopted by the NYSE MKT.American. In making these independence determinations, the Board of Directors considered all of the factors that automatically compromise director independence as specified in the NYSE MKT’sAmerican’s listing standards and determined that none of those conditions existed. In addition, the Board of Directors considered whether any direct or indirect material relationship, beyond those factors that automatically compromise director independence, existed between those directors, and director nominees, their immediate family members, or their affiliated entities, on the one hand, and us and our subsidiaries, on the other hand. The Board of Directors determined, for those directors identified as independent above, that any relationship that existed was not material and did not compromise that director’s independence.

Our independent directors meet in an executive session at least once per year. All standing committee members are independent for the purpose of the committees on which they serve.

Stockholders and other interested parties wishing to communicate with the Board of Directors should addressor a specific director may do so by delivering written correspondence to the Corporate Secretary of the Company whoat: Attn: Corporate Secretary, Ballantyne Strong, Inc., 4201 Congress Street, Suite 175, Charlotte, North Carolina 28209. The Corporate Secretary will present the communication to the Board.appropriate director or directors.

Board and Committee Meeting Attendance